Not earnings season yet, but too close for companies to say anything or buy back stock; it’s the quiet period. A Fed meeting, just a couple weeks away, but hopes for a rate cut; no GDP growth number for the second quarter but fears for a weak one; new China trade talks but doubts about a resolution anytime soon; there is plenty to worry about. As a result, trading is slow with many investors sitting on their wallets. It’s also summer and many are on vacation or spending more time with their families.

At the same time, markets have held up very well – even making a modest new high. Perhaps this is the proverbial “wall of worry” that good markets climb. Maybe the smart money senses better than expected outcomes. Certainly, money flows signified by strong buying pressure on a preponderance of stocks persist. We are seeing especially strong flows into banks, industrials, and technology. Healthcare stocks are improving. Commodities also appear to be setting up for higher prices. Next week, earnings reports start being issued in earnest. The Federal Reserve also meets so the blanks in information will gradually get filled in. Stay steady, my friends.

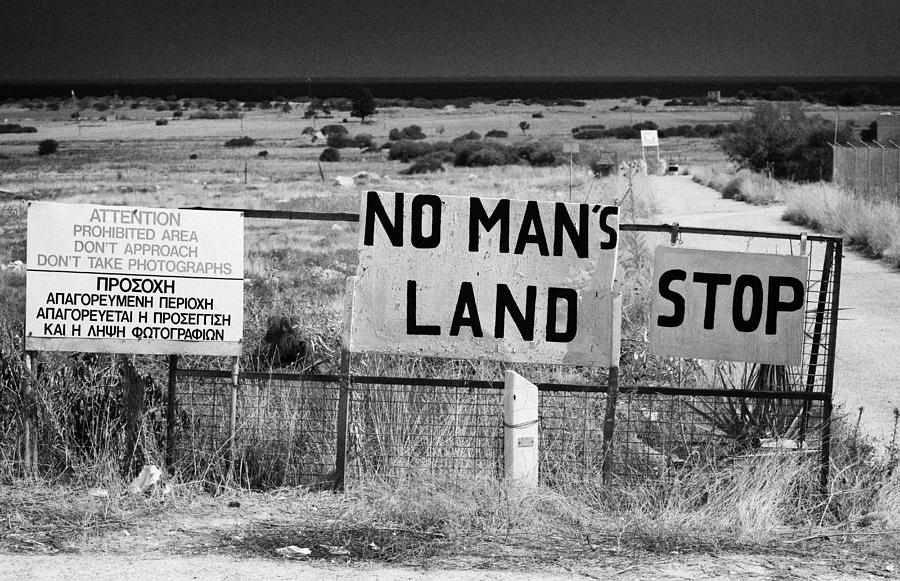

The Lonely Bull