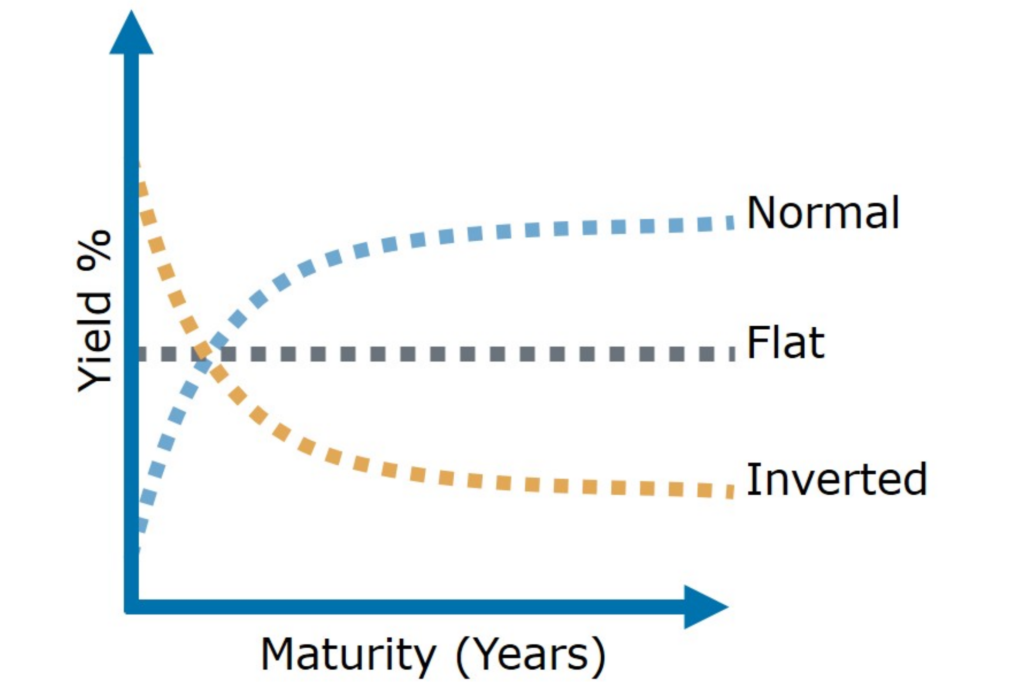

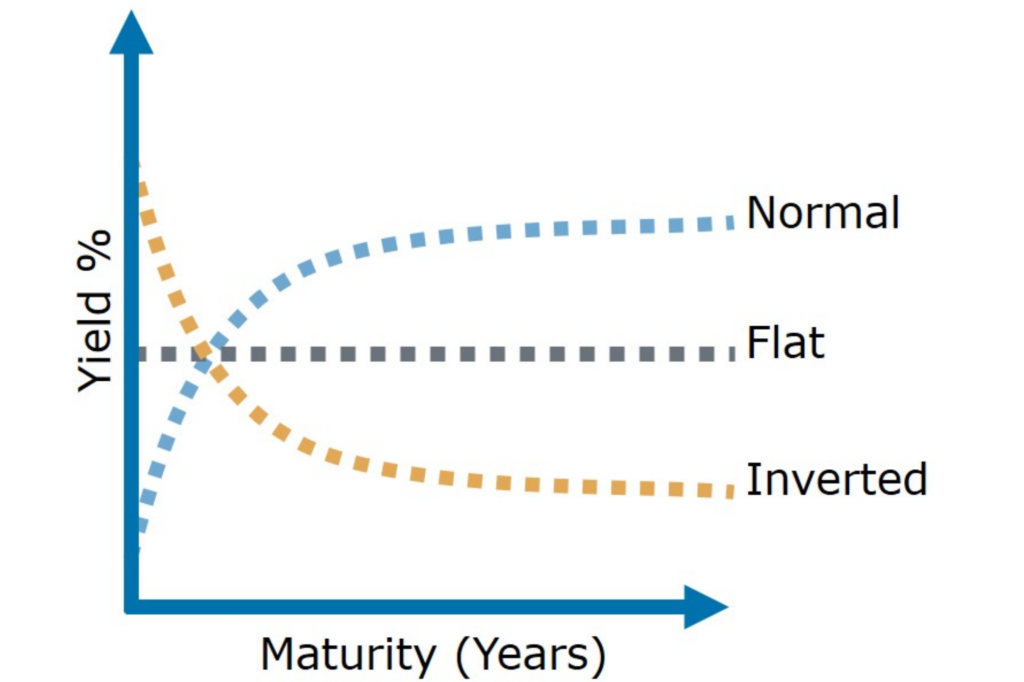

In the past, inverted yield curves have often predicted recessions in the United States. But what is “inverted?” Inversion refers to short-term interest rates that are higher than longer-term ones. This can occur when fixed income investors are so sure that the economy is going to skid into a recession that they want to have a rate committed before rates fall. Of the past seven inversions, only four have resulted in a recession; obviously, the predictive value is less than sure.

The inversion that has the greatest predictive power is when the federal funds rate is higher than that of the ten-year treasury bond. Even this is not a certain predictor. However, it is a clear warning and should be taken seriously. There are some circumstances that may mitigate the predictive power of any inversion. One is when interest rates are being heavily influenced by central bank policy; not just in the U.S., but in other major economies as well.

Today, Europe and Japan have very low or negative interest rates. Higher rates here attract international money flows for the higher returns. This pushes our rates down as these flows compete for our bonds. This has very little to do with domestic economic conditions. That is what the Lonely Bull believes is happening. However, he is certainly paying attention to many indicators.

So far, no recession is in sight; stay steady, my friends.

The Lonely Bull